What is Fintech?

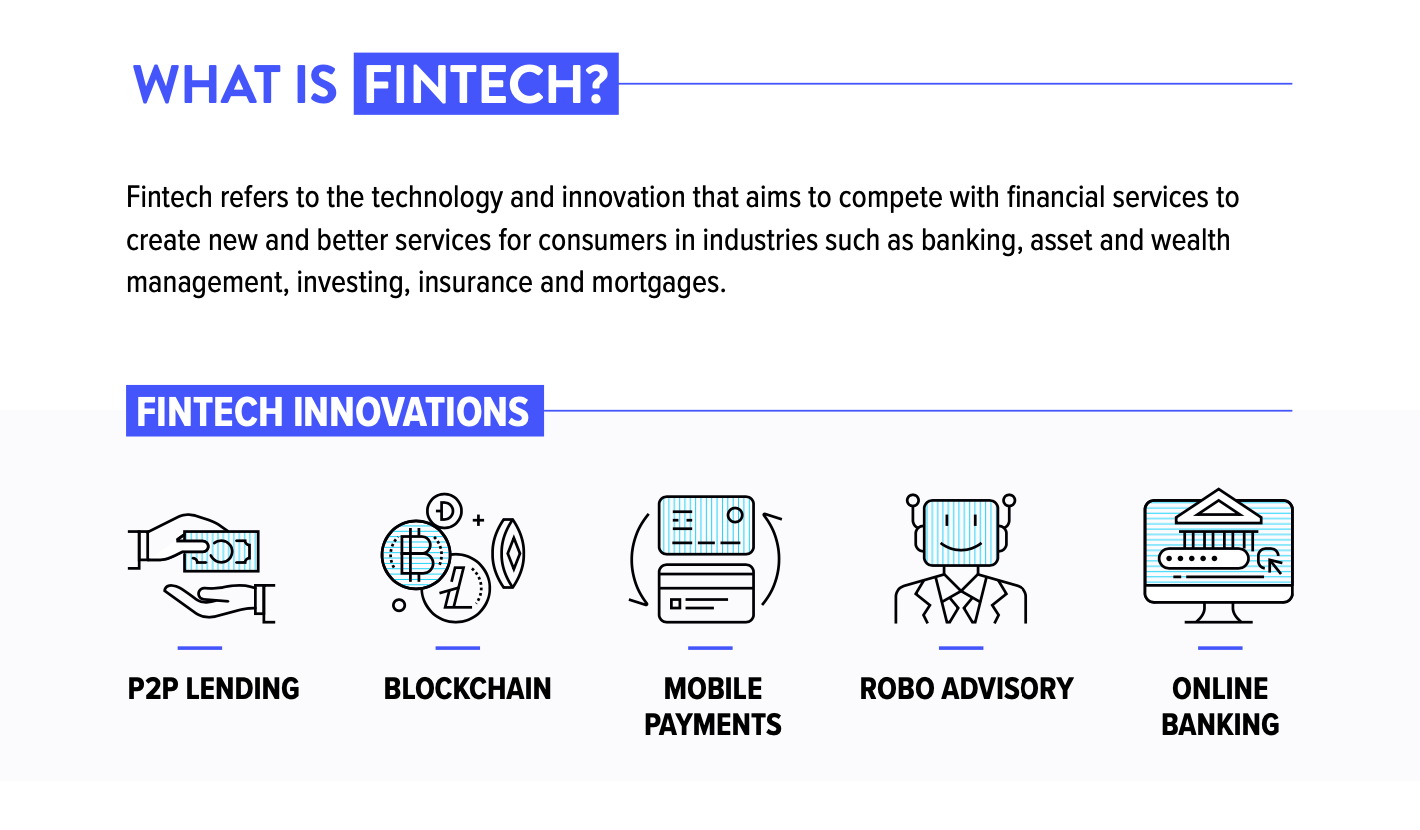

Originally, Financial Technology, or fintech, referred to the back end technology used to operate traditional financial services institutions. Today, the term has broadened to incorporate new technological innovations in the financial sector, such as blockchains, cryptocurrencies, robo-advising, and even crowdfunding. Simply put, fintech enhances financial activities through the application of technology.

The technology itself enables financial institutions to provide services in new, cutting-edge ways. For example, consider the convenience and efficiency offered by online banking versus visiting your local bank branch, or automated investing versus manual stock trading. According to EY’s 2019 Global FinTech Adoption Index, the adoption of fintech services increased from 16 to 33 percent between 2015 – 2017, reaching 64 percent in 2019.

In today’s digital era, the traditional services once provided by financial institutions are no longer meeting the needs of today’s tech-savvy consumers, who prefer to bank with just a click of a mouse or a swipe on their smartphone. As consumers become accustomed to the digital experience provided by tech leaders like Google, Amazon, Facebook, and Apple, they expect that same level of digitally integrated customer experience from their financial services providers. Fintech is riding the waves of disruption with services that can better meet consumer needs by providing enhanced accessibility, convenience, and tailored solutions.

Visa’s February 2020 purchase of Plaid for $5.3 billion marked one of the largest fintech-bank mergers of all time. Plaid is a fintech startup that allows users to link their bank accounts to third-party apps like Venmo, letting them easily share their financial data. This acquisition is just one example of the significant investment and interest in the fintech industry.

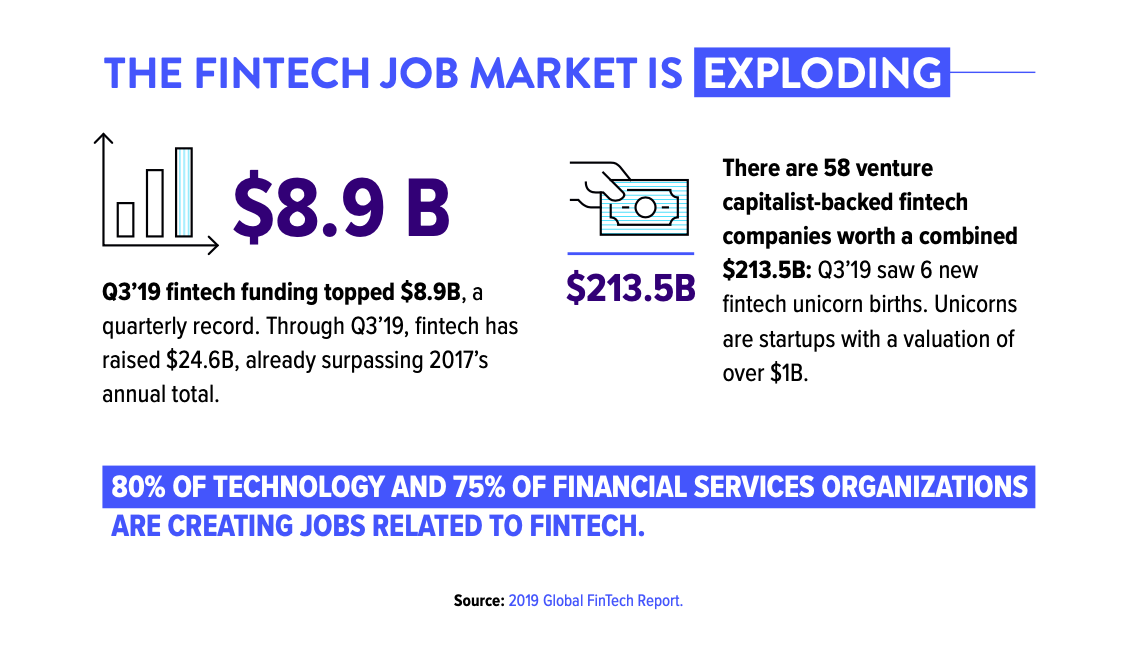

According to the 2019 Global FinTech Report, the fintech industry raised $24.6 billion in 2019, with funding topping $8.9 billion in the third quarter alone. Globally, there are 58 venture capitalist-backed fintech startups in verticals such as insurance, consumer lending, personal finance, and more, collectively valued at $213.5 billion.

Why is Fintech Important?

Even if you are not very familiar with fintech, it’s likely you’re already benefiting from it. Everything from your ability to go online and view your financial transactions to apps that allow you to instantly send and receive money are all part of the financial services evolution.

Fintech has also disrupted the e-commerce industry, making online shopping a quicker, safer process, even letting you purchase with digital wallets. Each time you use your credit card to shop online, you are enjoying the advantages of fintech. Thanks to the development of new fintech products like Apple Pay and Google Wallet, nearly all financial transactions can take place without you ever having to use a physical card.

Fintech allows you to manage all of your financial accounts – banking, investments, insurance – entirely online. Whereas these accounts once needed to be managed in-person or through a representative, they can now be easily self-managed online.

In-Demand Skills in the Fintech Industry

Many financial organizations today depend heavily on financial technology to power their infrastructure. There is now an unprecedented shift in how fintech is propelling financial services, and with that we see more and more financial institutions requiring talented and qualified professionals who can add value to their organizations. To meet the urgent demand, many boot camps have emerged to quickly upskill a vital workforce that is experiencing the challenges and opportunities of an industry undergoing a digital transformation.

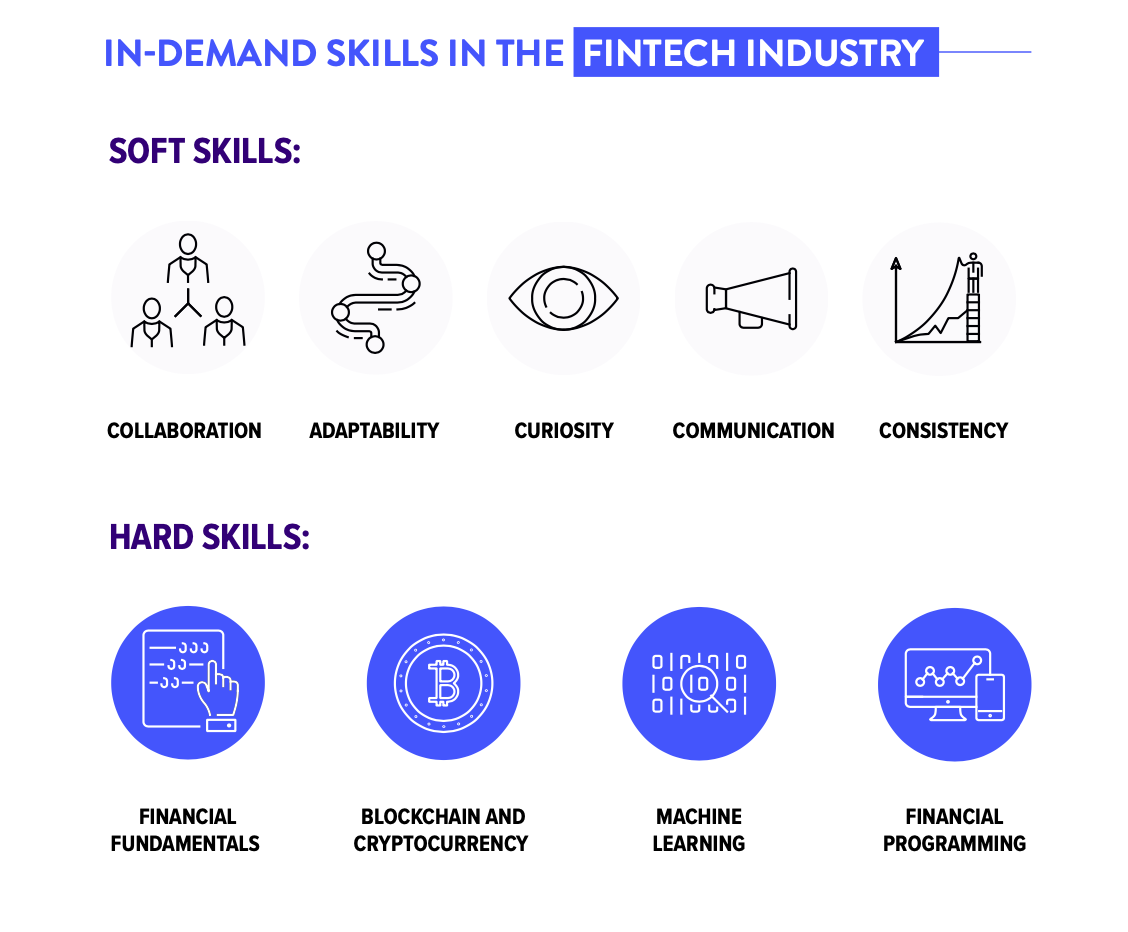

But what skills are organizations looking for? In the field of fintech, there are a number of skills and qualities that can help set qualified professionals apart from the competition. Below we have outlined several hard and soft skills that can help you become an in-demand and proficient fintech professional.

Soft Skills:

- Collaboration: Fintech professionals should value the importance of collaboration and making meaningful connections with others in the field. Employers and businesses not only hire based on skill set, but they also look for individuals who are great at working across dynamic teams.

- Adaptability: It is important to identify your current skills gap in relation to your future goals. For example, the skills needed for a fintech professional in banking are going to be somewhat different from that of a professional in the insurance field. A strong indicator of long-term success is the ability to adapt your skills and knowledge to evolving business needs.

- Curiosity: A fintech professional should possess a strong desire to obtain more knowledge and information. Curiosity drives the best fintech professionals forward, allowing them to expand their skill set while sharing their newfound knowledge with others.

- Communication: The financial and business findings formulated by fintech professionals mean nothing to a company if others cannot comprehend the results. While presenting financial information, you should be able to explain how the results impact the business. As such, fintech professionals must be able to clearly communicate their findings in order to make them useful to a company.

- Reputation: Building a name for yourself allows you to build a trusted network that can help you in your career. As you work with different clients, they may offer helpful referrals and positive word-of-mouth within their respective industries. With that reputation will come recognition.

Hard Skills:

- Financial Fundamentals: The best fintech professionals will have a solid understanding of the core financial fundamentals needed to succeed in the field. For example, it is important to develop a strong foothold in today’s marketable financial skills including financial analysis, financial ratios, and time-series analysis.

- Blockchain and Cryptocurrency: As the popularity of blockchain grows, so has the demand for finance professionals with skills such as Solidity, Ethereum, cryptocurrency, transactions, Smart contracts, Truffle Suite, and other related concepts. According to the Global FinTech Report, 77 percent of the financial services industry will adopt blockchain by the end of 2020. From reducing costs (an estimated savings of $15 – 20M by 2022) to reducing excessive bureaucracy in traditional banking, blockchain will continue to make banking a more seamless experience for both banks and customers due to its several advantages:

- Security and privacy

- Programmability and scalability

- Trust and transparency

- Reliably high performance

- Machine Learning Applications in Finance: It is important to learn the inner workings of machine learning applications in order to be marketable. Consider exploring the core fundamentals of algorithmic trading, Random Forests, financial modeling, forecasting, logistic regression, and support vector machines (SVMs).

- Python: Python is recognized by HackerRank as the fastest-growing fastest-growing language in finance. If you are looking to venture into the world of financial technology, you should be able to rely on a programming language that is secure, easy to scale, and trusted. You should also consider learning how to work with Python libraries like Pandas. Python is well-suited for the finance industry because it addresses highly specific needs such as

- Quantitative and qualitative data analysis

- Building platforms for risk and trade management

- Processing and analyzing large data sets

- Simplifying data regulation, compliance, and analytics

The Jobs in Fintech

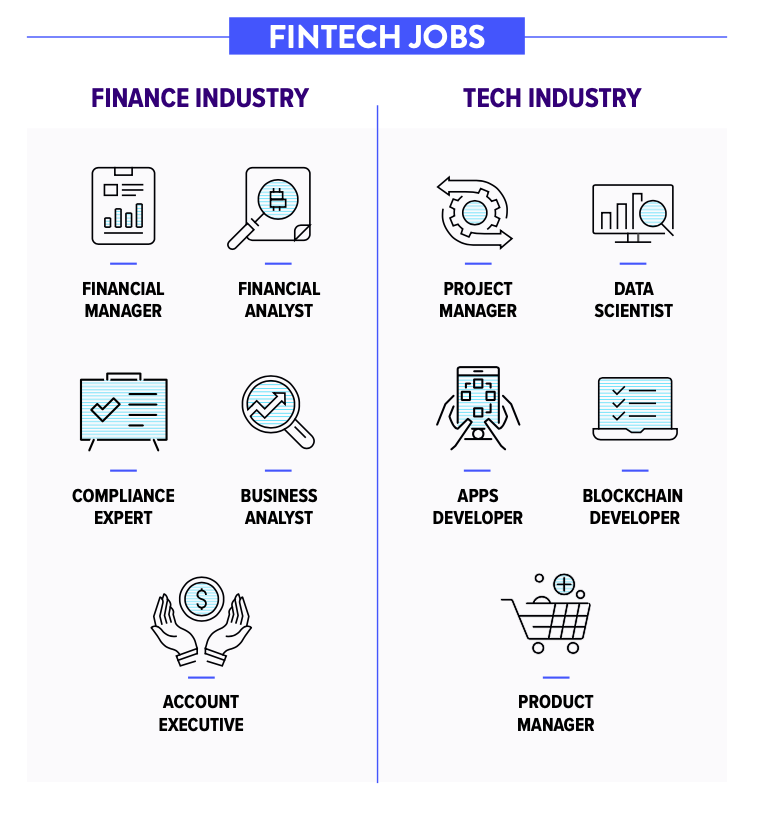

Fintech innovation is not only empowering consumers, but also members of the workforce by opening up new career options. With financial technology becoming increasingly important to companies’ bottom lines, fintech specialists are incredibly valuable in the professional world.

Take a look at some of today’s in-demand fintech jobs:

Conclusion

Just as financial institutions continue to adapt to a tech-driven economy, individual finance professionals must also equip themselves with the tech skills needed to thrive in the same fast-moving digital environment.

Whether you have years of experience in finance or are just getting started in the field, a boot camp is a great way to accelerate your fintech learning. Fintech boot camp attendees learn financial technology and analysis at a professional level, which provides them with the skills they need to bring value to a potential employer and this emerging industry as a whole.

This article was originally published on https://bootcamp.uncc.edu.