Business is an industry that knows no (or very few) bounds. In fact, if we were to cover all of the ways you could pursue a career in business, you’d be reading this for quite some time.

Due to the industry’s versatility, careers in business can span a variety of fields, functions, and competencies. Because of this, an education in business will give you the information and skill sets to succeed in the areas that interest you and align with your passions.

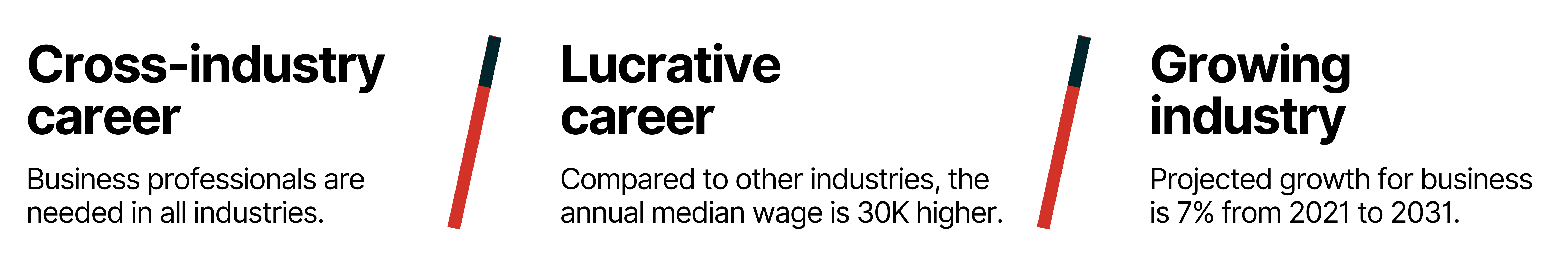

Not convinced yet? Here are a couple data points to give you an idea of what the industry has to offer and where it’s heading.

Let’s review this skill set together by discussing how business expertise can be acquired, applied, and transformed into a fulfilling career.

What can I do with business skills?

To know where your skill set fits within the industry, sometimes all it takes is a little research. Here’s what Business Intelligence Developer Taylor Lyons, had to say about their day to day in the industry:

“My day-to-day as a business intelligence developer is part of a larger ‘rhythm’ of work. I’ll typically have some focused periods (2-3 days) of scripting, debugging, and documenting, followed by stretches of lighter, customer-oriented work. These lighter days are typically sprinkled with requirements — gathering meetings, reporting requests, and opportunities for professional development. This is one of the aspects I love about my role.” — Taylor Lyons, business intelligence developer

Discover your career opportunities

The responsibilities of a business professional can vary greatly from position-to-position, but they all revolve around the functions and operations of business or financial matters. Here are some responsibilities that you may take on in this industry:

Expert advice

“With business, there are many different fields you could explore. Taking an assessment could help show how your personality affects the type of work you would enjoy. Are you more extroverted or more introverted? Are you more artistic or conventional? Assessments might provide insight into your ideal career!”

— Elizabeth Mimms, career expert at edX

How can I acquire business skills and turn them into a career?

If you’re interested in pursuing a career in business, we recommend taking these steps:

Research is key when it comes to any career, and a career in business is certainly no exception. Take advantage of all the information that’s out there, whether it’s through surfing the internet for job titles, listening to industry-specific podcasts, or getting connected to professionals in the areas or positions that interest you.

Pro tip:

Explore your career’s possibilities. As part of your research, take every opportunity to learn more about topics in your desired field. Browse the edX course catalog at edx.org to see what business-related topics, courses, and programs interest you and start advancing your career in business today.

One key part of the research phase is networking. This simple step is often overlooked and undervalued, but can have a significant impact on your career trajectory. If you want to get clear on your career goals and aspirations, you must take time to talk with professionals about what the work actually looks like.

By reaching out to professionals in your targeted fields, positions, and companies, you open a door of opportunity in your own career. It is invaluable to connect with business professionals who could vouch for you and gain hard-to-find intel about the industry or organizations of interest.

Pro tip:

When you’re pursuing a career in a field like business, there is no better way to get a foot in the door than networking. Start to build your network by looking within existing communities. Talk to classmates, industry peers, and others who share your interests. Here are a few resources to guide you as you explore your potential path in business and hone in on knowledge from those already working in the field.

Check out our Networking guide and Networking outreach samples for help getting started.

To supplement your understanding of what others are doing professionally, make sure to get clear on your own goals and aspirations. Ask yourself if the business industry is what interests you, or if it’s just business functions within another industry. The possibilities are endless.

In the world of business, there are many skill sets that employers value. Our advice is this: never underestimate the power of your transferable or seemingly unrelated skills. Here are a few areas for growth that are directly applicable to roles and functions within business:

As far as requirements go, the standard education requirement for an entry-level career in business is a bachelor’s degree. Beyond that, certifications and additional education can set you apart as a candidate.

The purpose of professional certifications is to demonstrate knowledge, skills, and abilities associated with your occupation. They also allow you to stand out to employers and peers by showcasing your dedication to the industry. Although not required, they can influence a hiring decision and help you jumpstart your career. Here are a few certification areas commonly seen in business:

Accounting — Certifications in accounting are common for accounting professionals looking for licensure. Depending on your experience level and interest in managerial roles, one of the following certifications may be right for you:

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Professional Certificate in Financial Accounting

Business analysis — Certifications in business analysis help to demonstrate your knowledge, competencies, and experience as a highly effective business analysis (BA) professional. Typically candidates must have BA experience for this type of certification. Here are a few certifications to consider:

- Certified Business Analysis Professional (CBAP)

- Financial Analysis of Insurance Companies

- Professional Certificate in Fundamentals of Financial Analysis

Strategy and management — Certifications in strategy and management complement and expand strategic planning and analysis skills, and validate project leadership experience and business expertise. Make sure to review any barriers to entry for these certifications, as some may require active participation in a CMA certification. Here are two that might interest you:

Other certification areas to consider — The certifications that you see in these sections are not exhaustive, as there are dozens of certifications you can pursue as a business professional. Take what you learned about yourself and others in the research phase to figure out which areas of business might be a good fit and make your certification decisions based on that. Here are just a few more that might pique your interest:

- Certified Information Systems Security Professional (CISSP)

- SAS Certified Specialist: Visual Business Analytics (SAS)

- Professional Certificate in Environmental Management for Sustainability

- Professional Certificate in Strategic Human Resources Management

Interested in taking your business education beyond a certification? Here are more structured learning options that you might consider:

Boot camps: These innovative programs are designed by experienced curriculum teams to help you achieve your career goals in a fraction of the time it takes to complete a traditional degree. Explore popular Business boot camps.

MBA: If learning the ins and outs of business through a holistic lens fascinates you, you may be interested in pursuing a master’s degree. Perhaps the biggest commitment for business professionals in terms of time and money, a Master of Business Administration (MBA) is a versatile degree that will prepare you to excel as a leader in organizations across all industries. Explore popular MBA programs.

Once you’ve decided that a career in business aligns with your professional goals, talents, and values, it’s time to dust off those materials. Check out some of our resources as you update your resume and cover letter, prepare for interviews, or craft your personal brand:

Keep in mind:

The business world is evolving, much like the rest of the career space. With an education in business, you will gain exposure to and an understanding of the wide-spectrum of industry practices. As you prepare to apply for roles or participate in interviews, do research on specific companies to get a feel for their culture and expectations.

Once you get your foot in the door of the industry, make sure to celebrate your success. The career journey is full of ups-and-downs and we believe that every victory deserves acknowledgement.

With that said, your journey doesn’t end here — it’s only just beginning. Give yourself grace and understand that careers are not linear. Here are some of the ways that you could continue growing within the business industry:

Continued learning — Always make sure to reference our course catalog on edX.org for continued learning opportunities. Now that you’ve secured a career in business, it never hurts to build upon industry knowledge or become a subject matter expert in areas that apply to your work, interests, or something in between.

Promotions — As you move up in business, you might find that your involvement with different industry functions is subject to change. Rather than analyzing information and coordinating tasks, your position may involve more managerial or strategy work.

Promotions in business:

Here are some titles of roles that you could grow into as you advance your career in business:

Mid level titles: Product Manager, Accounting/Finance Manager, Researcher, Director of Marketing, Director of Operations

Executive leadership roles: Chief Executive Officer (CEO), Chief Operations Officer (COO), Chief Financial Officer (CFO), Chief Human Resources Officer (CHRO), Vice president, Chief Information Officer (CIO), Managing Director, Executive Director, President

Once you reach the executive level of business leadership, your role will largely involve decision-making and direction-setting. Here is a C-Suite Resume Sample to give you an idea of what a seasoned career in business could look like.

Pivots — Make sure to regularly check in with yourself and your satisfaction with daily tasks. If you find yourself disinterested in your current role, take stock of the things you like and dislike about it, keep your eyes out for company-sponsored growth opportunities, and pursue career pivots that optimize your background, skill set, and interests.

Entrepreneurship — If you’re looking to start a new business soon or have already done so, the U.S Chamber of Commerce recommends that you consider what consumers need and want right now, develop a good digital marketing strategy, use social media, and remain positive and flexible.

Top industries for entrepreneurs:

Food and beverage, retail, business services, health, beauty, fitness, residential and commercial services, technology

What could my career look like with a business skill set?

It is difficult to say exactly what your life would look like as a business professional, but we do have some metrics about the realities of the industry. Consider how these may factor into your life plan:

Endless opportunities for growth — Professionals with business skills are valuable to all industries from data analytics to digital marketing. Our career experts suggest starting with your passions when looking for opportunities in the industry.

Global relevance — Business skills and education are sought after world-wide. Satisfy your cultural interests and expand your horizons by putting your education to work internationally.

Generous salary potential — According to the Graduate Management Admission Council, pursuing additional education in business pays off! By receiving their MBA, candidates significantly increase their salary potential. At $115,000, the median salary of MBA graduates is 77% more than those with a bachelor’s degree and 53% higher than candidates hired directly from industry (2021).

Entrepreneurship — According to Guidant’s “2023 Small Business Trends” report, roughly 28% of business owners started a company so that they could be their own boss. If that resonates with you, a business skill set gives professionals a leg up when it comes to entrepreneurship.

Ruben Ruvalcaba’s life in business

As a restaurateur, Ruvalcaba knows how much goes into owning a business. Listen as he explains what his career journey has taught him:

Everything helps, right? Every experience that you’re going through is a learning [experience] and everything, at the end, adds up to a goal. So, I always like to be in different circumstances and learn from different people, different profiles. Everything is for learning. So, definitely I would say that all the cities and companies and things that I’ve be doing during these years have led me to the place that I am right now.

What are my next steps?

Learn about topics in business:

Register for a course on edX to learn about a variety of topics within business such as Professional Certificate in Family Businesses: Entrepreneurship and Leadership to Transcend and Behavioral Economics in Action Course.

Watch a session:

Watch a relevant session on our Events page to learn more about the industry and other professionals’ experiences within it.